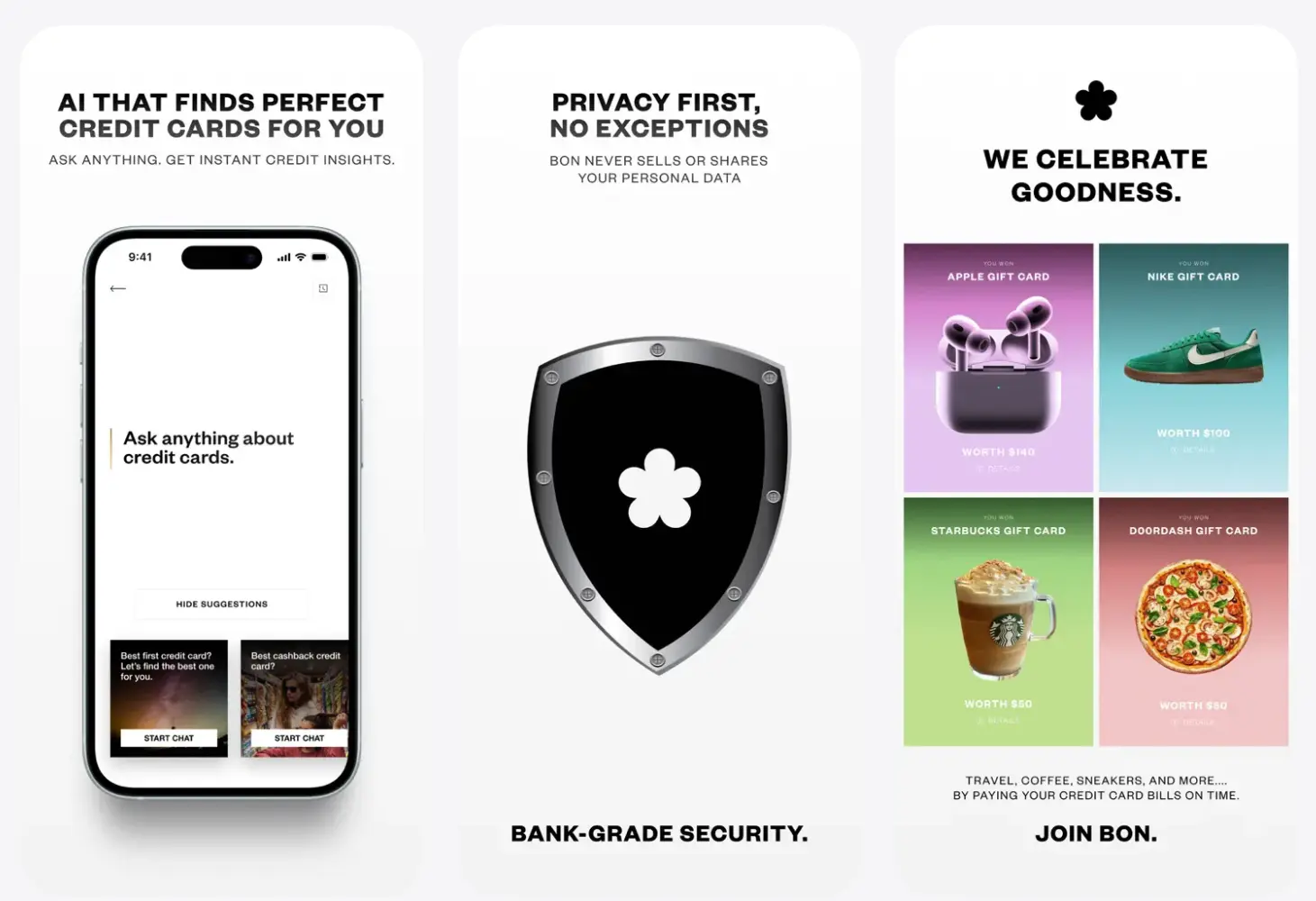

BON Credit is a free iOS app that helps you manage and reduce credit card debt through AI-powered analysis.

The app uses CredGPT, the company’s proprietary AI co-pilot, to help manage debt, repayment, and personal budgeting.

You can connect all your credit cards in one place, track balances and due dates, and get AI-generated payment strategies that prioritize which cards to pay first based on APR and utilization.

People with multiple credit cards face confusion about payment priorities, different due dates, and high interest rates that compound debt.

BON Credit analyzes your complete credit profile and creates a payoff plan that minimizes interest while rewarding you for on-time payments.

You earn BON Coins and gift cards from 500+ brands just for paying bills when they’re due.

Features

Multi-Card Dashboard: The app consolidates all your credit cards into a single view. You can see balances, due dates, and minimum payments across every card without switching between bank apps.

CredGPT AI Assistant: This AI tool answers questions about your finances and provides personalized credit card recommendations. The AI reviews more than 14,000 options in real time, comparing rewards, fees, eligibility and expert reviews.

Smart Payment Prioritization: BON Credit analyzes your APR rates, card utilization, and cash flow to recommend which cards you should pay first. This feature helps you minimize interest charges and pay off debt faster.

Unified Bill Pay: You can pay all your credit cards through the BON Credit app instead of logging into multiple bank accounts. The system routes payments directly to each card issuer.

Rewards System: Every on-time payment unlocks BON Coins, which you can redeem for gift cards from Apple, Amazon, Sephora, Chipotle, DoorDash, Spotify, and 500+ other brands.

Credit Card Finder: You can ask CredGPT to find cards that match your needs (like “best cash back card”). The AI searches thousands of options and gives unbiased recommendations based on your financial profile.

Payment Reminders: The app sends notifications before due dates so you never miss a payment.

Bank-Grade Security: BON uses Plaid for credit card connections and doesn’t store any financial data. All connections use encryption and follow industry security standards.

Use Cases

BON Credit works for several real-world debt management scenarios:

Multi-Card Juggling: You have four credit cards with different due dates (5th, 12th, 18th, 28th) and varying APRs (15%, 22%, 18%, 24%). BON Credit shows you which card to prioritize based on interest rates and balances, then reminds you before each due date. You can pay all four cards from within the app.

High-Interest Debt Reduction: Your highest APR card charges 24% interest and carries a $5,000 balance. BON Credit’s AI calculates how much extra to pay on this card each month while maintaining minimums on others. The strategy reduces your total interest by several hundred dollars over the payoff period.

New Credit Card Selection: You want a card with good travel rewards but don’t know which one matches your credit score and spending habits. CredGPT analyzes your profile, compares thousands of options, and recommends three specific cards with detailed explanations of rewards structures and approval odds.

Payment Habit Building: You have a history of late payments that damage your credit score. BON Credit sends timely reminders and rewards you with gift cards for consecutive on-time payments. The positive reinforcement helps establish better financial habits.

Cash Flow Optimization: Some months you have extra money and want to know the smartest way to allocate it across your cards. BON Credit’s AI runs scenarios to show you which payment strategy saves the most in interest charges based on your current balances and rates.

How to Use It

1. BON Credit requires iOS 15.6 or later. You can find it in the Apple App Store by searching “BON Credit” or visiting the direct App Store link.

2. Open the app and enter your phone number. The system sends a verification code to confirm your number.

3. BON Credit uses Plaid to link your cards. You select your card issuer from a list of banks, then log in with your banking credentials. Plaid securely connects your cards to BON without storing your login information. The setup for each card takes about 30 seconds.

4. The app displays all connected cards with current balances, credit limits, due dates, and APR rates. You can see your total debt across all cards and your overall credit utilization percentage.

5. CredGPT analyzes your cards and generates a payment strategy. The AI tells you which card to pay first and recommends payment amounts based on your available cash flow.

6. You can pay cards directly through the BON Credit app. The system links to your bank account (again using Plaid) to facilitate payments. You can schedule one-time payments or set up recurring payments for minimum amounts.

7. Turn on push notifications so BON Credit can remind you about upcoming due dates and alert you when payments process successfully.

8. Each on-time payment adds BON Coins to your account. You can view your coin balance in the rewards section and redeem coins for gift cards from participating brands.

9. You can chat with the AI assistant about credit card questions like “Should I close my oldest card?” or “Which card should I use for groceries?” The AI provides personalized answers based on your financial profile.

10. The app shows you how much interest you’ve saved by following its payment recommendations. You can also see your payment history and trends over time.

Pros

- Completely free: The core app has no fees for use, card linking, or its AI planning.

- Action-oriented AI: It provides a clear, actionable payoff plan instead of just presenting analytics.

- Built-in motivation system: The rewards program directly incentivizes the positive habit of paying bills on time.

- Streamlines payments: Managing and paying multiple cards from one interface saves time and reduces mental clutter.

- Strong security posture: It employs bank-grade encryption and partners with established data connectors.

Cons

- Platform limitation: It’s currently only available for iOS (iPhone, iPad, Mac), excluding Android users.

- Data linking required: You must provide read-access to your credit card accounts.

- Future premium tier: The app is free now, but the company has mentioned that premium functions are expected to be added in early 2026.

- Dependent on partner connectivity: Card linking relies on Plaid’s coverage, so some smaller financial institutions might not be supported.

Related Resources

- Plaid Security Overview: Learn about the security infrastructure that BON Credit uses to connect your financial accounts.

- Federal Trade Commission Credit and Loans: Review government guidance on understanding credit cards, interest rates, and debt management strategies.

- Credit Card Payoff Calculator by Bankrate: Use this calculator to understand how different payment amounts affect your payoff timeline and total interest.

- Consumer Financial Protection Bureau Credit Reports: Access official information about credit reports, scores, and your rights as a consumer.

- NerdWallet Credit Card Reviews: Compare credit card options and read detailed reviews to supplement CredGPT’s recommendations.

FAQs

Q: Does BON Credit charge any fees for using the app or making payments?

A: BON Credit is completely free. The company doesn’t charge subscription fees, transaction fees, or any hidden costs. You can connect unlimited cards, make unlimited payments, and access all features at no charge.

Q: How does BON Credit keep my financial information secure?

A: BON Credit uses Plaid to establish secure connections with your banks. Plaid is the same infrastructure that major fintech companies and banks use for account connections. BON Credit itself doesn’t store your banking credentials or detailed transaction data. All data transmission uses bank-grade encryption. The company follows industry-standard security practices and doesn’t sell your financial information to third parties.

Q: Can I connect credit cards from any bank to BON Credit?

A: BON Credit supports all major card networks through its Plaid integration. If your bank doesn’t support Plaid, you won’t be able to connect those specific cards to BON Credit.

Q: How does the BON Coins reward system work?

A: You earn BON Coins automatically when you make on-time payments through the BON Credit app. Each on-time payment adds coins to your balance. You can redeem accumulated coins for gift cards from 500+ brands including Apple, Amazon, Sephora, Chipotle, DoorDash, and Spotify.

Q: What happens if I miss a payment deadline or pay late?

A: BON Credit sends reminders before your due dates to help you avoid late payments. If you do miss a deadline, you won’t earn BON Coins for that payment. The late payment affects your credit score according to your card issuer’s policies (not BON Credit’s).

Q: Can CredGPT really find better credit cards than I can find myself?

A: CredGPT searches 14,000+ credit card options and compares them based on multiple factors like rewards structure, annual fees, APR, sign-up bonuses, and your approval odds. The AI can process this information much faster than manual research.

Q: Does using BON Credit affect my credit score?

A: Connecting your cards to BON Credit through Plaid doesn’t affect your credit score. Plaid uses a “read-only” connection that doesn’t trigger hard inquiries. Paying your bills on time through BON Credit helps your credit score the same way paying through your bank’s website would. If you use CredGPT’s credit card finder and apply for new cards, those applications can trigger hard inquiries that temporarily lower your score by a few points.

Q: Can I use BON Credit if I live outside the United States?

A: BON Credit is built for the U.S. market and works with U.S. credit cards and banks. The app focuses on American credit card issuers and the U.S. credit system.